-

Anglický jazyk

Anglický jazyk

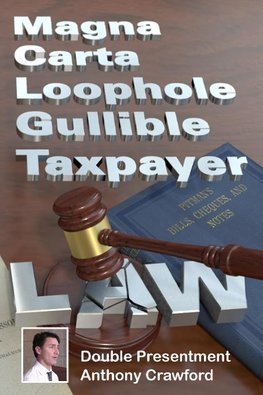

Magna Carta Loophole Gullible Taxpayer Law

Autor: Anthony Crawford

The 1215 Magna Carta Loophole was established for the Bank of England behind the first deficit economy in the world in 1694. It was discovered in the 'COMER' lawsuit in 2017 when Canadian taxpayers sued HRH Queen Elizabeth the Second for clarification of... Viac o knihe

Na objednávku

16.20 €

bežná cena: 18.00 €

O knihe

The 1215 Magna Carta Loophole was established for the Bank of England behind the first deficit economy in the world in 1694. It was discovered in the 'COMER' lawsuit in 2017 when Canadian taxpayers sued HRH Queen Elizabeth the Second for clarification of ancient tax law how 'Double Presentment' distorts the budget to the benefit of the superrich the world over.

"The wealth of our middleclass has been ripped from their homes and distributed all across the world. But, that is behind us and we are looking only to the future"

The Federal Court of Canada denied trial of debt to foreign banks instead of its 'Public Bank of Canada' behind twice paid deficit dollars hidden from the Treasury, not reported int he budget, which is 'Magna Carta Loophole Gullible Taxpayer Law.'

If the government had used its Public Bank of Canada 1974 to 2012; it would not have had $500 billion national debt, it would have saved more than $1 trillion interest instead of cost of money paid foreign banks, and had a $13 billion surplus in the budget.

The largest expenditure was interest paid private banks; more than national defense, or social security, or health care. The government cut back $6 billion in programs, 20,000 public jobs, and increased retirement to 67 to tax more from longer working lives.

Crawford reviews private NOTES ON THE LAW how public money flows to tax-credit billionaire.

- Vydavateľstvo: New Generation Publishing

- Rok vydania: 2020

- Formát: Paperback

- Rozmer: 229 x 152 mm

- Jazyk: Anglický jazyk

- ISBN: 9781789558586

Nemecký jazyk

Nemecký jazyk