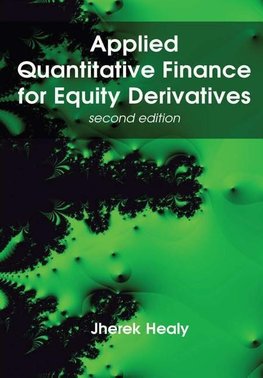

Applied Quantitative Finance for Equity Derivatives, second edition

Revised and corrected in December 2018, this book presents the most significant equity derivatives models used these days. It is not a book around esoteric or cutting-edge models, but rather a book on relatively simple and standard models, viewed from the... Viac o knihe

Produkt je dočasne nedostupný

75.42 €

bežná cena: 83.80 €

O knihe

Revised and corrected in December 2018, this book presents the most significant equity derivatives models used these days. It is not a book around esoteric or cutting-edge models, but rather a book on relatively simple and standard models, viewed from the angle of a practitioner.

A few key subjects explained in this book are: cash dividends for European, American, or exotic options; issues of the Dupire local volatility model and possible fixes; finite difference techniques for American options and exotics; Non-parametric regression for American options in Monte-Carlo, randomized simulations; the particle method for stochastic-local-volatility model with quasi-random numbers; numerical methods for the variance and volatility swaps; quadratures for options under stochastic volatility models; VIX options and dividend derivatives; backward/forward representation of exotics.

This second edition adds new arbitrage-free implied volatility interpolations, and covers various warrants, such as CBBCs.

- Vydavateľstvo: Lulu Press

- Formát: Hardback

- Jazyk:

- ISBN: 9780244741587

Anglický jazyk

Anglický jazyk